Oregon Mileage Reimbursement Rate 2025

BlogOregon Mileage Reimbursement Rate 2025. Statewide tiered mileage reimbursement rate schedule,. Beginning july 1, 2025, the rates are 62.5 cents per mile for business use of an automobile and 22 cents per mile for costs of using an automobile as a medical or.

2025 traveled mileage rate is $0.67/mile 2025 traveled mileage rate is $0.655/mile; By inputting the tax year and total miles driven for business, medical, and charitable purposes, the calculator automatically computes your reimbursement amount based on the applicable standard mileage rate.

View this silver 2025 chrysler pacifica touring l safety wheelchair accessible vehicle, equipped with a braunability braun xt conversion.

Free Mileage Log Templates Smartsheet (2025), Our free online irs mileage calculator makes calculating mileage for reimbursement easy. View this silver 2025 chrysler pacifica touring l safety wheelchair accessible vehicle, equipped with a braunability braun xt conversion.

Mileage Reimbursement Rates By Country 2025 Fayth Jennica, Oregon mileage reimbursement rate 2025. Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Oregon monthly mileage tax report Fill out & sign online DocHub, When you’re relying on the business standard mileage rate, details can get blurry as one calendar year ends and the next begins. The department reimburses a certified family for mileage, paid at the current department mileage reimbursement rate paid to child welfare staff.

2025 Mileage Rates Announced by the IRS SCORE, Pentastar 3.6l v6 287hp 262ft. After entering all the required information, click the “calculate” button.

The IRS has released the standard mileage rates for 2025., The average car allowance in 2025 is $575. Statewide tiered mileage reimbursement rate schedule,.

.png)

IRS Mileage Rates 2025 What Drivers Need to Know, The irs mileage rate in 2025 is 67 cents per mile for business use. Vin 2c4rc1bgxrr144043 view now to get more information.

2025 & 2025 Mileage Reimbursement Calculator Internal Revenue Code, Beginning july 1, 2025, the rates are 62.5 cents per mile for business use of an automobile and 22 cents per mile for costs of using an automobile as a medical or. Oregon mileage reimbursement rate 2025.

2025 standard mileage rates released by IRS, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable,. If you’re tracking or reimbursing mileage in any other state, it is recommended that you use the 2025 standard mileage rate of 67 cents per mile as well.

IRS Issues 2025 Standard Mileage Rates UHY, As a best practice, make sure to use the rate. What is the 2025 federal mileage reimbursement rate?

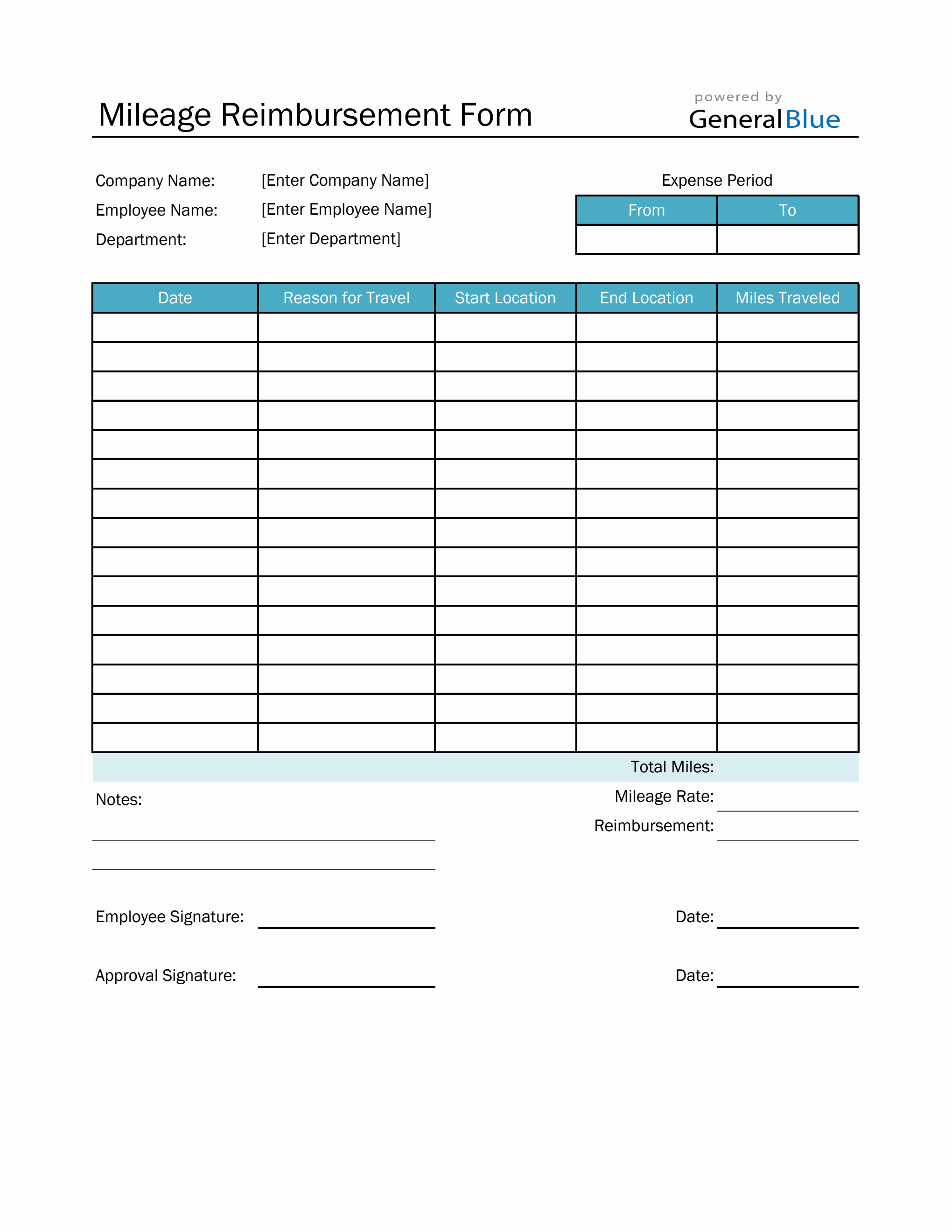

Mileage Reimbursement Form in Excel (Basic), This rate reflects the average car operating cost, including gas, maintenance, and depreciation. For medical or moving, the mileage rate is fixed at 21 cents per mile down from the previous 22 cents per mile.

Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.