Ira Income Limits 2025 For Deductions

BlogIra Income Limits 2025 For Deductions. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira. These ranges determine how much of your ira contribution can be deducted from your.

Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income. $6,500 (for 2025) and $7,000 (for 2025) if you’re under age 50.

Ira Limits 2025 For Deductions 2025 Cheryl Thomasina, You can make 2025 ira contributions until the. The irs recently announced the 2025 ira contribution limits, which are $500 more than the limits for 2025.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, Whether or not you can make the maximum roth ira contribution (for 2025 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

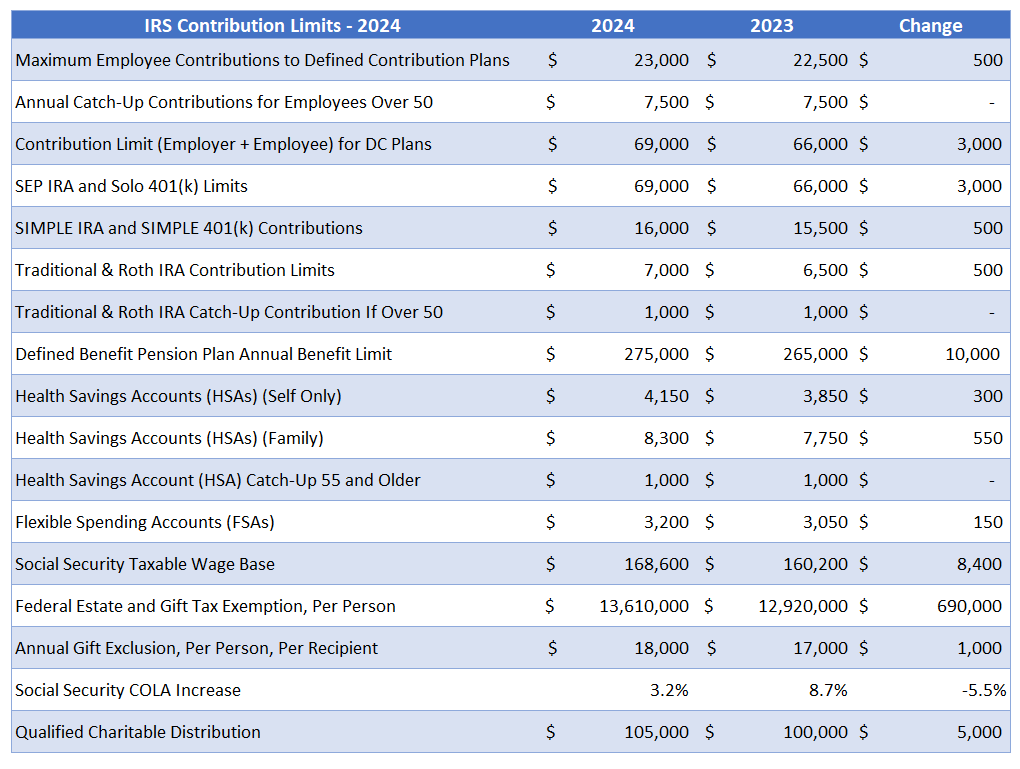

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, The irs recently announced the 2025 ira contribution limits, which are $500 more than the limits for 2025. The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

Ira Limits 2025 For Deductions 2025 Cheryl Thomasina, This is an increase from 2025, when the limits were $6,500 and $7,500,. However, keep in mind that your eligibility to contribute to a roth ira is based on.

2025 Limits For Traditional Ira Clair Demeter, Find which ira is best for your goals. Ira contribution limit increased for 2025.

Traditional Ira 2025 Contribution Limit Barry Carmela, Full deduction if magi is less than $68,000. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

2025 Roth Ira Contribution Limits Calculator Sally Karlee, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income. Find out if you can contribute and if you make too much money for a tax deduction.

Roth Ira Limits 2025 Eleni Hedwiga, This is an increase from 2025, when the limits were $6,500 and $7,500,. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

2025 Ira Contribution Limits Irs Over 50 Janaye Sarita, Full deduction if magi is less than $68,000. $6,500 (for 2025) and $7,000 (for 2025) if you're under age 50.

Limits For Roth Ira Contributions 2025 Gnni Shauna, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Find which ira is best for your goals.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.